do you have to pay inheritance tax in arkansas

If you receive property in an inheritance you wont owe any federal tax. What Is The Sales Tax In Arkansas.

How To Create A Living Trust In Arkansas

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state.

. According to the 2021 House Price Index the average property value in the UK is 256405. Keep Certified Online Experts in Any Field at Your Fingertips. It is true that there is no federal inheritance tax but there is a federal estate tax.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Bar-Certified Lawyers are Ready Now. Do you have to pay inheritance tax in Arkansas.

If you inherit property you dont have to pay a capital gains tax until you sell the plot. Inheritances that fall below these exemption amounts arent subject to the tax. All Major Categories Covered.

Can You Refile Taxes After Filing. Ad Find Reliable Answers to Legal Questions Online. How To Do Taxes For Doordash.

The first rule is simple. Arkansas Inheritance and Gift Tax. Do you have to pay taxes on.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. This does not mean however that Arkansas residents will never have to pay an inheritance tax. Although Arkansas does not require you to pay an inheritance or estate tax youre not exempt from paying them entirely.

Arkansas also has no inheritance tax. Do you have to pay taxes on inheritance money. This gift-tax limit does not refer to the total amount you.

Thats because federal law doesnt charge any. Arkansas does not have an inheritance tax. An inheritance can be a windfall in many waysthe inheritor not only gets cash or a piece of property but doesnt have.

Select Popular Legal Forms Packages of Any Category. In 2021 the current federal estate exemption is 117. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount.

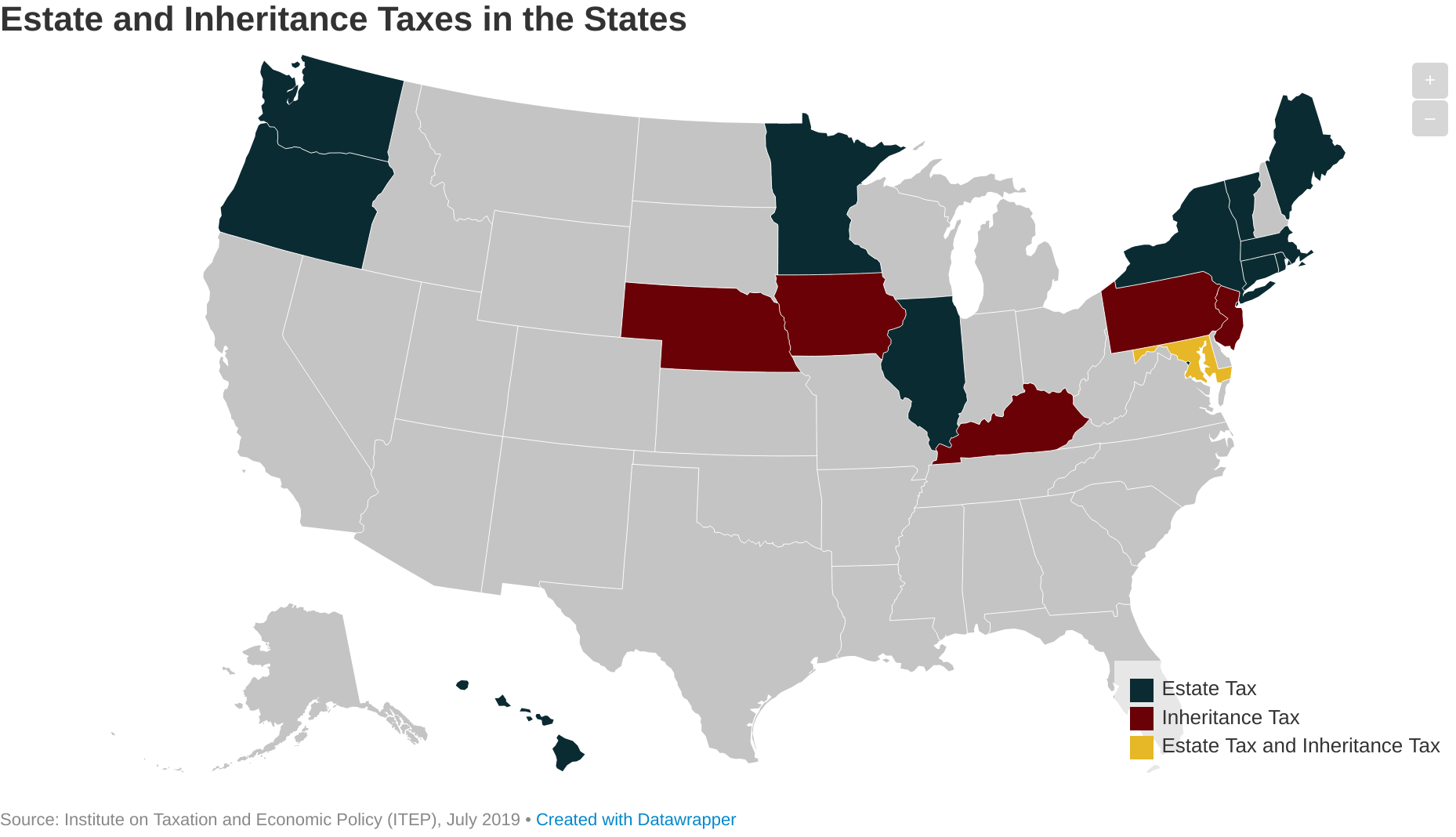

The Basic Rule. Few taxpayers have to pay federal estate taxes but may be billed by 17 states and the District of Columbia that tax inheritances andor estate assets. Inheritance laws of other states may apply to you though if you.

Any exemptions allowed by the. The inheritance laws of another. If you inherit property you dont have to pay a capital gains tax until you sell the plot.

Children and other beneficiaries face different tax laws depending on the state. Inheritances Arent Taxed as Income. There is no federal inheritance tax.

Surviving spouses for example do not pay inheritance tax. I inherited from my brother in law who passed a - Answered by a verified Tax Professional.

Arkansas Income Tax Calculator Smartasset

State Archives Page 335 Of 432 Pdfsimpli

10 Most Least Tax Friendly States For Retirees Cheapism Com

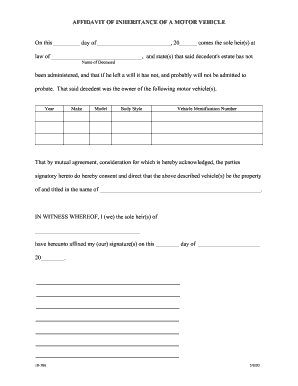

Affidavit Of Inheritance Of A Motor Vehicle Arkansas Fill And Sign Printable Template Online Us Legal Forms

Arkansas Income Tax Calculator Smartasset

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Arkansas Affidavit Inheritance Fill Online Printable Fillable Blank Pdffiller

Dear Arkansas Employer Pdf Free Download

Executing An Estate In Arkansas What You Need To Know Milligan Law Offices

How To Create A Living Trust In Arkansas

Arkansas Affidavit Inheritance Fill Online Printable Fillable Blank Pdffiller

Estate And Inheritance Tax State By State Housing Gurus

Arkansas Inheritance Laws Inheritance Loans Usa

How To Create A Living Trust In Arkansas